Why Ad-Driven Ecommerce Growth Is Losing Its Economic Advantage

For much of the last decade, ecommerce growth followed a predictable economic pattern. Brands allocated budget to paid media, acquired customers at scale, and reinvested revenue into more acquisition. As long as acquisition costs remained stable, this loop appeared efficient.

However, the economic conditions that supported this model have shifted. Advertising platforms have matured, competition has intensified, and customer attention has become increasingly scarce. What once delivered predictable returns now exposes brands to volatility and diminishing efficiency.

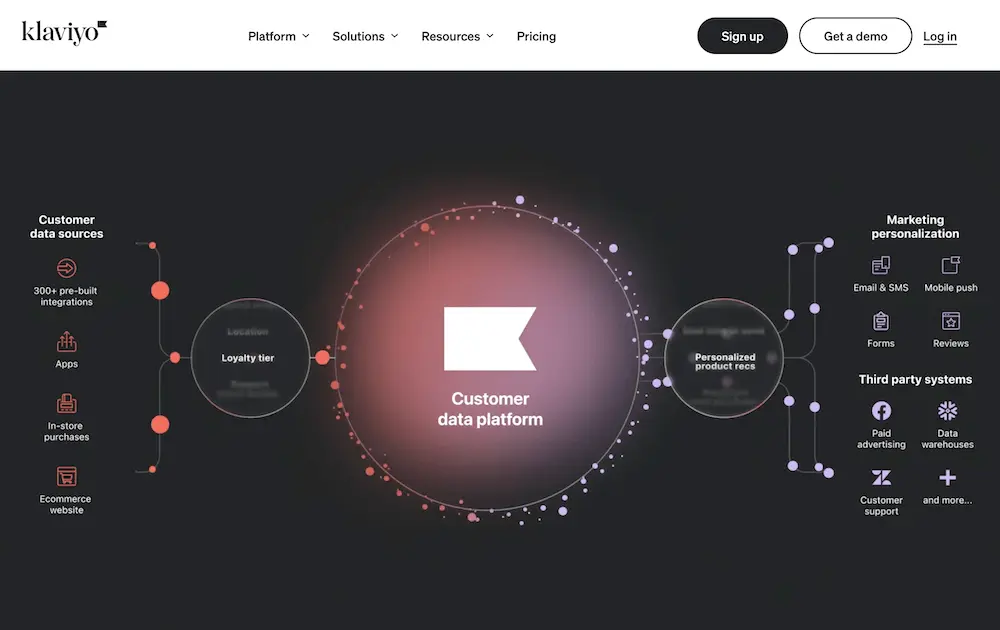

This shift has prompted many ecommerce operators to reassess how growth is generated. Rather than maximizing short-term acquisition, they are prioritizing owned marketing channels—particularly email, SMS, and customer data platforms like Klaviyo—that create compounding value over time.

Paid Media Has Shifted From Growth Lever to Cost Center

Paid advertising remains an important channel, but its role has changed. As platforms mature, they prioritize stability, first-party data, and historical performance signals. This favors established advertisers while raising barriers for sustainable scaling.

Across the ecommerce landscape, brands encounter similar economic signals:

- Customer acquisition costs rising faster than average order value

- Performance volatility driven by auction dynamics and algorithm updates

- Scaling spend producing linear—or declining—returns

When paid media operated as a growth multiplier, inefficiencies could be absorbed. In today’s environment, inefficiencies compound negatively, eroding contribution margins and increasing risk.

Why Linear Growth Models Break at Scale

Ad-driven growth is inherently linear. Revenue grows only when spend increases, and stops the moment spend is reduced. This structure limits long-term scalability.

From an economic perspective, linear systems lack memory. Each customer acquisition resets the equation rather than building upon previous investments.

| Linear Growth (Ads) | Compounding Growth (Owned) |

|---|---|

| Revenue tied directly to spend | Revenue increases without proportional spend |

| No lasting asset created | Customer relationships accumulate |

| High exposure to platform risk | Greater operational control |

As brands scale, these structural differences become increasingly consequential.

Owned Marketing as an Asset, Not a Channel

Owned marketing is best understood as asset creation rather than campaign execution. Email lists and SMS subscribers represent direct access to customers, independent of third-party platforms.

Unlike paid impressions, owned audiences appreciate in value. Each interaction adds context, behavioral insight, and trust.

- Customer data becomes richer over time

- Messaging relevance improves with engagement

- Conversion efficiency increases as trust compounds

Retention Changes the Unit Economics of Ecommerce

Retention is often framed as an operational improvement, but its economic impact is strategic. Repeat customers typically exhibit higher lifetime value, lower servicing costs, and greater purchase predictability.

From a unit economics perspective, improving retention expands margin without increasing acquisition spend.

This creates resilience. Brands are less dependent on constant top-of-funnel pressure and more capable of absorbing market fluctuations.

Turning Data Into a Growth Engine

Data alone does not drive growth. Growth emerges when data is unified, interpreted, and operationalized.

Platforms like Klaviyo centralize behavioral, transactional, and engagement data into a single customer view, enabling brands to act on insight rather than assumption.

- Behavior-triggered messaging replaces static segments

- Lifecycle flows adapt as customer patterns change

- Retention strategies evolve continuously

Email and SMS as Compounding Infrastructure

Email and SMS are not simply communication tools. When automated and data-driven, they form infrastructure that supports long-term revenue generation.

Email provides depth and context, while SMS delivers immediacy. Together, they support every stage of the customer lifecycle.

Conclusion: Growth Follows Ownership

The economics of ecommerce growth have changed. Brands that rely exclusively on paid acquisition face increasing costs and declining leverage.

By investing in owned marketing infrastructure through platforms like Klaviyo, brands shift from linear growth to compounding advantage.

In a market defined by volatility, ownership creates stability.